Remote work trends pushed buyers toward spacious Pasadena properties. Families sought larger homes near top-rated schools. The city’s charm—historic architecture, vibrant culture, and proximity to Los Angeles—amplified its appeal. Yet, the supply struggled to keep up. Only 127 new listings hit the market, down 15% from September. Many sellers hesitated, fearing health risks or holiday disruptions. This scarcity intensified buyer urgency. Bidding wars erupted, especially for move-in-ready homes. Meanwhile, economic uncertainty lingered. Job losses and health concerns loomed large. Still, Pasadena’s market roared forward, rewriting the rules

The least expensive sale was a three-bedroom, one-bathroom, 760-square-foot home at 464 Avocado Ave., which sold for $635,000. The most expensive sale was a five-bedroom, eight-bathroom, 8,322-square-foot home located at 1725 Orlando Rd. This gorgeous estate sold for the asking price of $7,690,000.

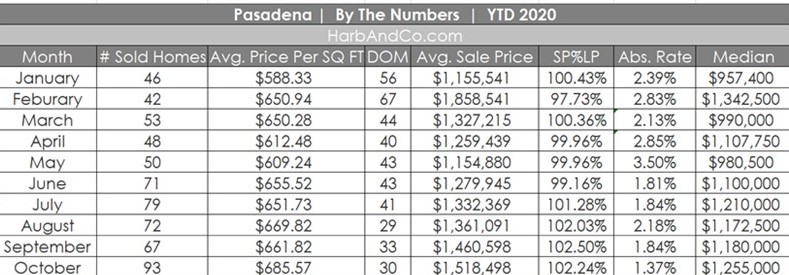

The Pasadena housing market is on fire! Of the ninety-three homes sold last month, fifty-two sold over their asking price. Eight sold for asking. Thirty-three sold below the asking price. The absorption rate of 1.37% is the lowest for the year.

“Housing continues to be a bright spot during an otherwise challenging economic time for many U.S. households. Those in sectors that weathered the transition to remote work successfully are now able to take advantage of low mortgage rates to purchase a home for the first time or to trade up to a larger home.” Frank Martell, President and CEO of CoreLogic