How Inherited Property Can Save You Thousands in Taxes: Understanding the Step-Up in Basis: If you’ve inherited a home or are planning your family’s real estate legacy, one tax rule can make a massive difference in how much you (or your heirs) may owe the IRS: the “step-up in basis.”

As real estate professionals, we’re not tax advisors — but we are here to help you make smart, well-informed decisions. Understanding the Step-Up in Basis:

What Is a Step-Up in Basis?

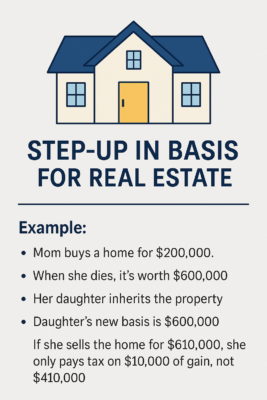

When someone inherits real estate, the IRS allows the property’s tax basis — essentially, its value for calculating capital gains — to be “stepped up” to the market value at the time of the previous owner’s death.

Why does that matter? Capital gains taxes are based on the difference between a property’s basis and its sale price.

Example:

Your father bought a home in 1990 for $150,000. He passed away in 2025, and the home is now worth $650,000. You inherit the home. Your new stepped-up basis is $650,000. If you sell it a month later for $655,000, you’d only owe taxes on the $5,000 gain, not the $505,000 difference from the original purchase price.

Avoiding a Common Mistake: Don’t Gift It Early

Many people think they’re doing their children a favor by gifting property during their lifetime. Unfortunately, this often creates a big tax bill later, because the recipient inherits the original basis, not a stepped-up one. If you aim to transfer wealth with minimal tax burden, inheritance (not gifting) is typically the smarter path.

How We Help as Your Real Estate Advisors

As realtors, we don’t provide legal or tax advice — but we know enough to recognize situations where a step-up in basis might apply, and when it’s wise to pause and speak with a CPA or estate planning attorney.

We help you:

Understand the potential tax impact of selling an inherited property.

Coordinate with your financial and legal team.

Market inherited properties with a tax-smart strategy.

Avoid mistakes that could cost you or your heirs tens or hundreds of thousands in avoidable capital gains taxes.

If you’ve recently inherited a home, or you’re helping a family member plan their estate, the step-up in basis rule could save you a significant amount in taxes — but only if it’s handled properly.

Contact us anytime for guidance, referrals to trusted professionals, or help evaluating your options. We’re here to sell homes and help you build and protect long-term wealth through smart real estate decisions.

This is such an incredibly important thing to know. Thanks I will pass the info along to my kids