This just in from Russell Cerpa, one of my preferred mortgage lenders: As it stands some lenders can qualify loans up to 48%-50% of the applicant’s monthly gross income. Real estate lending changes are coming! Next year the debt-to-income threshold will decrease by 5%-7%. This will have an impact on how much home someone can qualify for in 2014. So borrowers who are at the current threshold will be forced to bring in a larger down payment. Otherwise, they will need to decrease their purchase price.

Here’s the excerpt from the article: “Some buyers shopping for a luxury home are hoping to close the deal before Jan. 10. That is when new rules are scheduled to take effect that will tighten lending standards.

Issued by the Consumer Financial Protection Bureau (CFPB). The changes aim to curb loose practices that caused the real-estate meltdown. These new regulations encourage lenders to underwrite only “qualified mortgages” that meet the stricter standards. Those that don’t could face a lawsuit from borrowers if they default on the loan down the road.

Essentially, borrowers in 2014 will receive little leniency when digging out tax returns and documenting assets and potential earnings, says Tom Wind, executive vice president of residential and commercial lending at national lender EverBank Financial Corp.”

Read the rest of the article here:

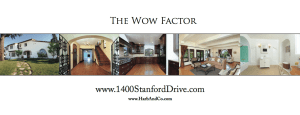

I have three luxury home listing each able to close by January 10:

www.926EncantoDr.com Arcadia $1.588 m

www.4434Mariota.com Toluca Lake $1.1 m

www.1400StanfordDrive.com Glendale $1.185 m

For more information regarding the real estate lending changes, feel free to contact me or one of my preferred mortgage lenders.