Let’s dissect the La Canada Housing Market in September 2020. The least expensive sale was a two-bedroom, one-bathroom, 1,000-square-foot home located at 4403 Indiana Ave. It sold for $710,000, which was $1,000 over the asking price. The most expensive home sold was a six-bedroom, six-bathroom, 6,324-square-foot home. Located at 5011 La Canada Blvd., it sold for $4,035,000.

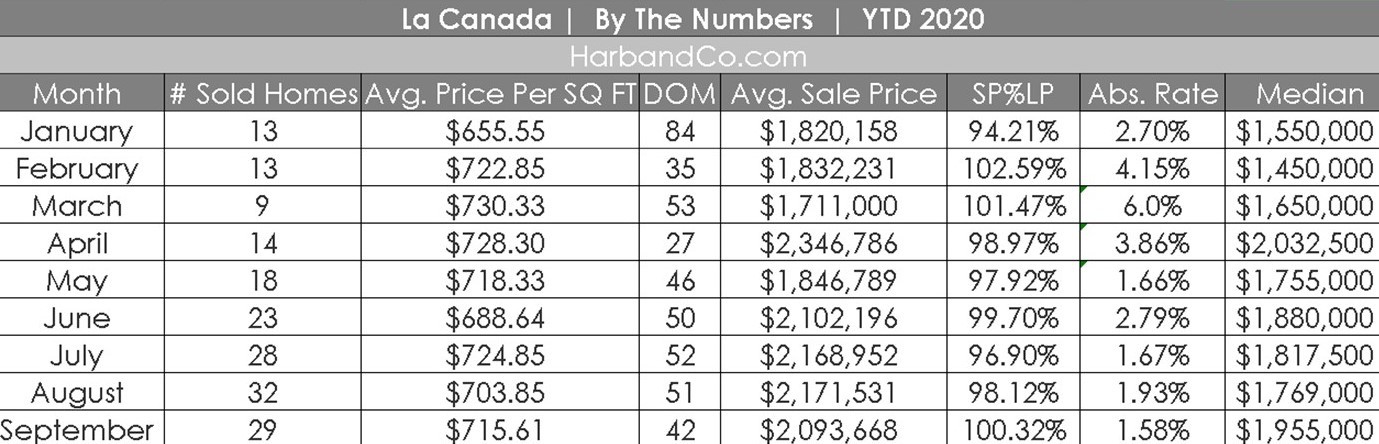

In your typical annual real estate cycle, September is when sales would fall due to the beginning of the school year and upcoming holidays. But in 2020, we have learned nothing is typical. Real estate has been one of the few bright spots in our economy this year. Interest rates remain low. Most homes are selling quickly, often after a bidding war! Twenty-nine homes sold last month. Eleven of these homes sold over the asking price, six at the asking price, and twelve sold for less than asking. Eight homes had price reductions before selling. The imbalance between homebuyer demand and listing inventory is particularly acute for entry-level buyers.